As cybercrime continues to rise, we want to take this opportunity to remind our valued vendors and customers of the importance of secure payment practices. Protecting both our business and your financial interests is a top priority.

According to a recent Association for Financial Professionals (AFP) survey, 80% of organizations were targets of payment fraud activity in 2023 – an increase from 65% in 2022.

Source: AFP: 2024 Payments Fraud and Control Survey1

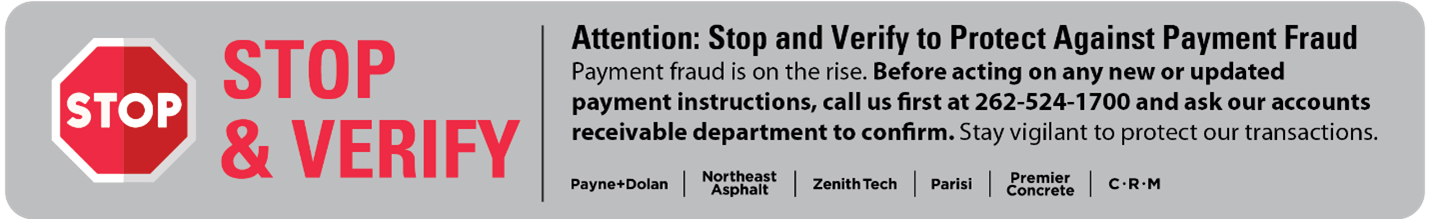

Fraudsters may use a phone, text, email, or other communication methods to request payment or change payment instructions regarding transactions. We remind you to stop and verify any payment instructions you receive, whether new or revised, by calling us at (262) 524-1700 and asking to speak to our accounts receivable department. This would be for any ACH/EFT transactions with our Walbec Group companies, including Payne and Dolan, Zenith Tech, Northeast Asphalt, Premier Concrete, Parisi, and Construction Resources Management.

The Growing Threat of Cybercrime

Cybercrime is becoming increasingly sophisticated, with criminals often targeting financial transactions between businesses and vendors. Accounts payable departments are especially vulnerable to schemes like phishing, business email compromise, and fraudulent payment requests. These scams can result in significant financial losses and operational disruptions.

To ensure the security of your transactions, it’s essential to be cautious and vigilant when processing payments or handling sensitive financial information. Here are a few critical practices to protect your organization:

- Always verify payment details. Ensure any payment instructions or changes are communicated directly through the approved channels. Never rely solely on email or text instructions, as these systems can easily be compromised or impersonated. Verify the sender’s email and phone number. Scammers usually use contact information that is misspelled or unrelated to the company.

- Be cautious of urgent or unusual requests. Scammers often create a false sense of urgency to bypass routine verification procedures. If something feels off, take a moment to verify the request through trusted channels.

- Educate your team. Ensure that all employees in your accounts payable department are trained to recognize the signs of cyber scams and understand the importance of following security protocols.

Stay Vigilant to Protect Our Transactions and Organizations

Our goal is to maintain secure business practices and reduce the risk of fraud. Together, we can protect our businesses from cybercrime and ensure our transactions remain safe and secure.